Content

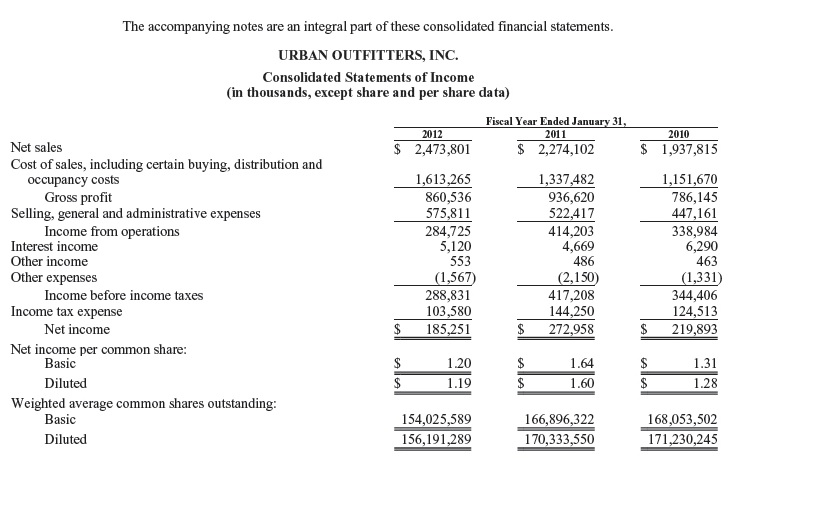

A semi-variable cost, also known as a mixed or semi-fixed cost, is composed of a mixture of fixed and variable components. A variable cost is an expense that changes in proportion to production or sales volume. The fixed cost ratio is a simple ratio that divides fixed costs by net sales to understand the proportion of fixed costs involved in production. Generally, depreciation on machinery is classified as a fixed cost.

What Is Depreciated Cost? Depreciated cost is the value of a fixed asset minus all of the accumulated depreciation that has been recorded against it. In a broader economic sense, the depreciated cost is the aggregate amount of capital that is "used up" in a given period, such as a fiscal year.

As a result, direct labor costs are now regarded as fixed costs. Estimate the total fixed costs .The total fixed costs are simply the point at which the line drawn in step 2 meets the y-axis. Remember, the line meets the y-axis when the activity level is zero. Fixed costs remain the same in total regardless of level of production, and variable costs change in total with changes in levels of production.

Unlike variable costs that are volume-dependent, fixed costs are incurred at a given point in time, and the expenditure is known to the firm’s owners beforehand. We have now learned about two types of Is depreciation a fixed cost or variable cost? cost behavior patterns—variable costs and fixed costs. A committed fixed cost is a fixed cost that cannot easily be changed in the short run without having a significant impact on the organization.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 https://online-accounting.net/ & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. The write-off of the cost of plant and equipment is called __________.

The following table shows how fixed costs are fixed, regardless of levels of production, over a relevant range. Small businesses with higher fixed costs are not like those with high variable costs—costs that vary with revenue and output such as raw material and distribution costs. Companies with high fixed costs need to produce more to break even but they also have higher profit margins than companies with high variable costs, according to Business Dictionary.